Item Costing Method in Oracle NetSuite

- Article By : Rostan Team

- Jan 24, 2024

A costing method is an organization's strategy for collecting cost data to accurately determine the total cost and cost per unit of a finished product, whether it's a physical good or a service. The inventory costing method you choose in NetSuite plays a crucial role in how item costs are calculated. For instance, it impacts how NetSuite handles inventory cost calculations when the same item is purchased at different prices over time.

NetSuite offers several inventory costing methods, including:

-

- Average: Costs are determined by dividing the total units available during a specific period by the sum of the beginning inventory cost and the cost of additional inventory. This method is also known as the moving average.

- First-In First-Out (FIFO): This method assumes that the first items purchased are the first to be sold, meaning that the ending inventory consists of the most recent purchases. It’s particularly useful for tracking different shipments of similar products.

- Group Average: This method allows you to track a single average cost for an item across multiple locations within a defined group.

- Last-In First-Out (LIFO): LIFO assumes that the last items purchased are the first to be sold, with the ending inventory made up of the earliest purchases.

Note: LIFO is not available in the NetSuite Australia (AU) edition.

Case Study: Navigating Complex Costing Requirements for a Growing Subsidiary

Expanding a business often brings new challenges, especially when integrating additional subsidiaries with existing systems. One of our clients, a technology company, recently faced such a scenario. They had been successfully managing inventory costs using the standard average cost method across multiple subsidiaries. However, the introduction of a new subsidiary required a more nuanced approach. Specifically, they needed a single weighted average cost for each item, grouped by location within this new subsidiary—a need that deviated from their existing configurations and business practices. This case study explores how we addressed this requirement using Oracle NetSuite's group average costing method.

Deep Analysis of Costing Methods

When managing inventory in NetSuite, the default costing method is the average costing method, which calculates costs by dividing the total units available during a specific period by the sum of the beginning inventory cost and the cost of additional inventory. However, there are some key aspects to keep in mind:

First, once a costing method is chosen during the creation of an item master, it becomes permanent and cannot be changed. Additionally, if inventory levels dip into the negative, NetSuite automatically uses the last purchase price as the costing method.

To better understand how different costing methods can impact inventory valuation, let’s explore a simple example:

Imagine it's Monday, and you've purchased 20 calculators at ₹10 each, adding them to your inventory. The next day, you buy another 20 calculators, but this time at ₹15 each. On Wednesday, you sell 5 calculators to a customer. How these calculators are recorded depends on the costing method:

-

- FIFO (First-In First-Out): The 5 calculators are recorded at ₹10 each, reflecting the cost of the first batch added to inventory.

- LIFO (Last-In First-Out): These calculators are recorded at ₹15 each, based on the cost of the last batch added.

- Average: The calculators are recorded at ₹12.50 each, calculated as the average cost of all the calculators in inventory: [(20 × ₹10) + (20 × ₹15)] / 40 = ₹12.50.

- Group Average: If your inventory is spread across multiple locations within a group, the cost per calculator would still be ₹12.50.

It's also crucial to distinguish between average cost and group average cost. For example, if you purchase Item A from two different locations—Location X at ₹100 and Location Y at ₹200—the impact on inventory varies depending on the method:

-

- Average Costing Method: Selling Item A from Location X would reduce inventory by ₹100, while selling from Location Y would reduce it by ₹200.

- Group Average Costing Method: If both locations are part of the same group, selling Item A from either location would reduce inventory by ₹150, the weighted average of the two costs.

This differentiation highlights how NetSuite's costing methods can significantly influence your inventory valuation strategy.

Proposed Solution and Configuration

To meet the client's requirement of a single weighted average cost per item grouped by location within the new subsidiary, we implemented NetSuite's group average costing method. This configuration involves three main steps:

1. Enabling Group Average Costing

-

- Navigate to Setup > Company > Setup Tasks > Enable Features.

- Under the Items & Inventory subtab, check the Group Average Costing box.

- Click Save.

2. Creating a Location Costing Group

-

- Navigate to Setup > Accounting > Location Costing Groups.

- Enter a Name for the group (e.g., "New Subsidiary Locations").

- Optionally, add a Memo for future reference.

- If using NetSuite One World, select a Currency in the Costing Group Currency field to limit the subsidiaries available for the group.

- Under the Location subtab, select the locations to include in the group.

- Click Save.

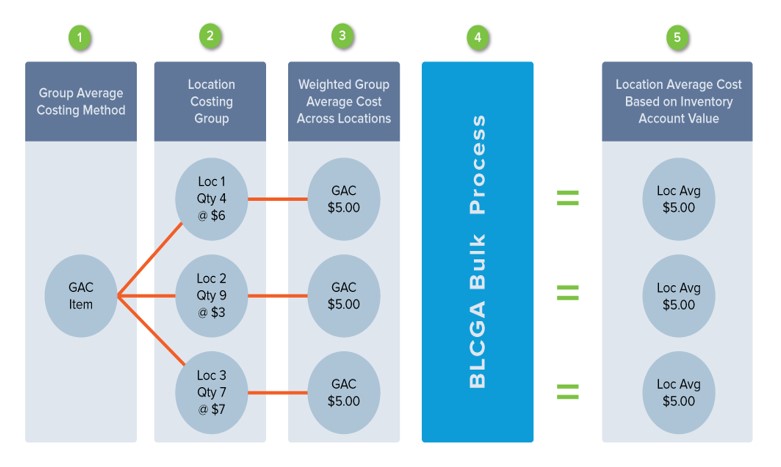

3. Balancing Location Costing Group Accounts

When using Multi-Location Inventory combined with Group Average Costing, it's important to regularly process account adjustments to maintain consistent item costs within costing groups. This ensures that location balance sheets accurately reflect group average cost items. By balancing location costing group accounts, NetSuite adjusts individual location inventory values to align with the group average cost.

The "Balance Location Costing Group Accounts" page enables you to periodically adjust location inventory accounts to match group average costs. This ensures that the inventory account balances are correctly aligned with the location quantity multiplied by the group average cost.

To keep location accounts consistent, NetSuite analyzes transactions at each location within a costing group and posts the necessary account variances. This process helps to balance accounts across all locations, taking rounding into consideration.

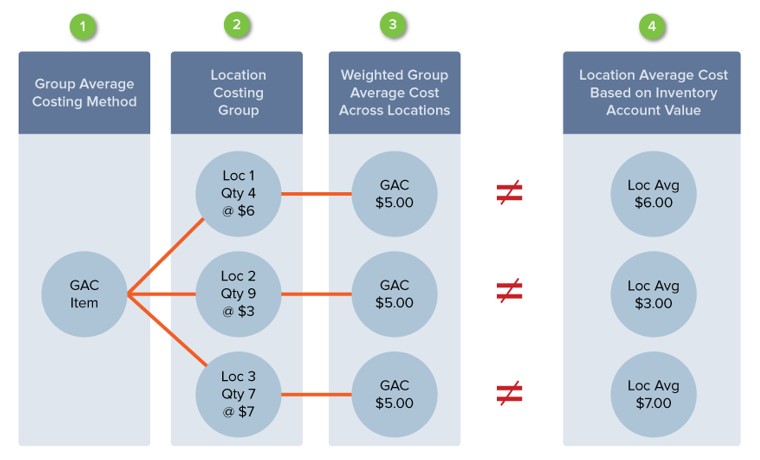

As shown in the accompanying diagram, without making these adjustments, costs across different locations may not align.

Refer to the image provided above for the following key details:

-

- Group Average Costing Method: This method is specified on the item record, determining how costs are managed across locations.

- Location Assignment: Locations are grouped together under the Location Costing Group record.

- Group Average Cost Calculation: The group average cost for an item is calculated by dividing the total inventory account value across all locations by the total quantity across those locations.

- Location Average Cost Calculation: The average cost at a specific location is determined by dividing that location’s iinventory account value by the quantity at that location.

Note: When a transaction affects the inventory costing of a Group Average Cost item, NetSuite calculates an average cost across all locations within the costing group. This calculated group average cost is then applied uniformly to the item across all locations.

In the diagram, each location records the item at a different receiving cost:

-

- Location 1 = $6.00

- Location 2 = $3.00

- Location 3 = $7.00

For each specific location, the total in the inventory asset account is based on the location’s receiving cost, calculated by multiplying the receiving cost by the quantity received. This specific inventory asset cost may not match the group average cost, meaning the inventory value at a location may differ from the value calculated using the group average cost (location quantity multiplied by group average cost).

It’s important to note that the average cost can vary between locations and may differ from the Group Average Cost. NetSuite calculates the average cost as the account value divided by the quantity.

By using the Balance Location Costing Group Accounts page, you can make general ledger adjustments to ensure accounts are balanced across all locations.

Key Insights from the above diagram:

-

- Group Average Costing Method: This method is specified within the item record, determining how inventory costs are managed across different locations.

- Location Assignment: Locations are grouped together under the Location Costing Group record, enabling collective inventory management.

- Group Average Cost Calculation: The group average cost for an item is calculated by dividing the total inventory account value across all locations by the total quantity across those locations.

- Balancing Accounts: Use the Balance Location Costing Group Accounts feature to post general ledger adjustments, ensuring accounts are balanced across all locations.

- Location Average Cost Calculation: The average cost at a specific location is calculated by dividing that location’s inventory account value by the quantity at that location.

The Balance Location Costing Group Accounts page allows you to adjust inventory at the end of a selected period, such as at the close of a financial period. You can also perform these adjustments more frequently, such as on a weekly basis, to keep account balances up-to-date.

By implementing this approach, our client successfully integrated a new subsidiary into their existing NetSuite environment, maintaining accurate and consistent inventory costing across all locations. This case study demonstrates the flexibility and effectiveness of Oracle NetSuite's inventory costing methods in meeting complex business needs.

Conclusion

Oracle NetSuite offers robust capabilities for calculating weighted average costs in a location-specific manner, enhancing accuracy.

The system supports both configurations at the item level across the same or different subsidiaries, allowing for customized costing methods per location. This feature provides flexibility which is valuable for businesses with multiple subsidiaries requiring tailored costing methods.

We understand that this feature may be of interest to many organizations. Our team has extensive experienced in Oracle NetSuite implementation and can help you configure the system to meet your specific needs.